petfood pro 4/2021

- Text

- Packaging

- Ingredients

- Marketing

- Products

- Pets

- Nutrition

- Turtles

- Owners

- Premium

- Protein

- Petfood

- Harnischcom

Packaging Label

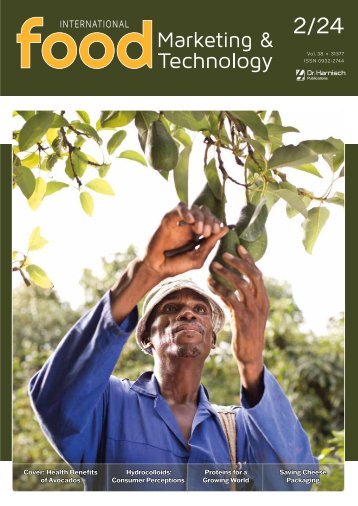

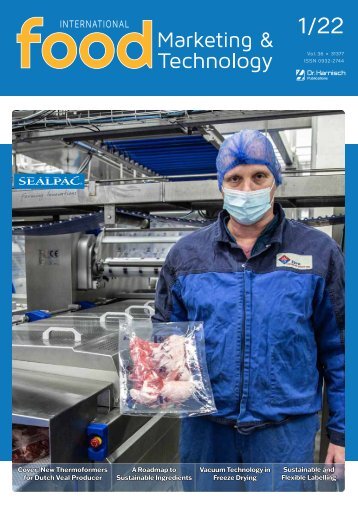

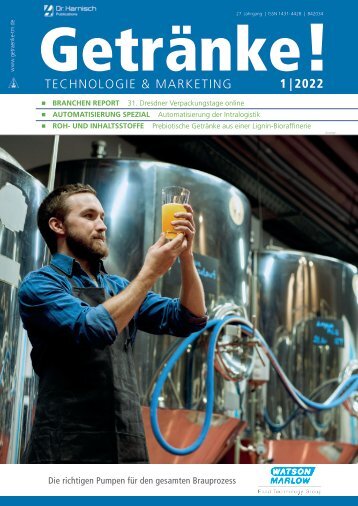

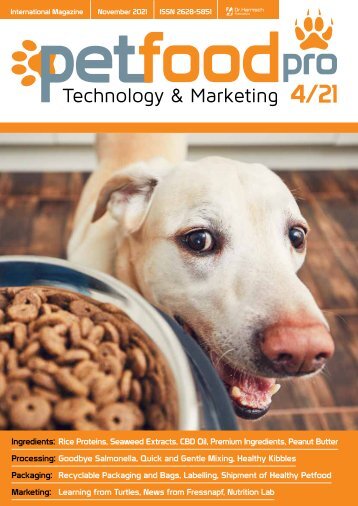

Packaging Label Innovations offer More Creating stand-out packaging for Millennial brand differentiation in the pet food aisle The pandemic and associated lockdowns have accelerated trends in many industries. In the pet industry, pet ownership has risen dramatically. According to the European Pet Food Federation (FEDIAF), approximately 38% of all households in the European Union now own a pet, a total of 88 million homes 1 . Meanwhile, data from the Pet Food Manufacturers’ Association shows that 2.1m Brits collected a new pet during lockdown and notably, more than one-third (35%) of young adults, age 24- 35, have, or are planning to, embark on lives as new pet owners 2 . Increased demand for pets naturally equates to increased demand for pet food - the European pet food market is projected to see a CAGR of 4.5% between 2021 and 2026 3 . In the increasingly competitive pet food market, a point of difference is vital to brands hoping to stand out and capture market share, particularly among Millennials and Gen Z consumers. As startup brands jostle for shelf space with wellestablished big players, such as Mars and Nestle, the need for dynamic, vibrant packaging that can grab the attention of the consumer is very clear. For pet food brand owners there are several key trends influencing the market that can filter into pack design. Most notably, and perhaps a key driver behind all other trends, is the increase in the humanization of pets across Europe. Pet humanization is becoming a globally accepted term in the pet industry as owners treat their pets like a family member and seek to provide them with human-like products or experiences 4 . Pet owners are happy to indulge and spend heavily on ensuring the best quality of food for their pets. This has led to an increasing number of premium products entering the pet food market. “If brand owners are developing higher quality food for pets, then they need packaging that also suggests ‘premium’ or ‘finest’,” says Susan Ellison, joint MD at OPM (Labels and Packaging) Group. “Introducing tactile, gloss and foil finishes, embossing or high-definition graphics to pack design all respond to the demand for superior quality and exclusivity. Combine this with enhanced pack functionality, such as easy tear or resealability for greater convenience, and the perception of premium products is more appealing, and pet owners likely to treat food as something worth spending a little extra on. “When consumers are faced with a shelf of products that all claim to have better quality and highly nutritious ingredients, the pack becomes the shop window for the brand. It can create the all-important shelf-standout and ultimately, influence purchase decisions in a moment.” Beyond more premium, nutritious ingredients for improved digestive health, skin and coat care, the pet food market is seeing significant growth in organic and plant-based foods, replicating the alternative diet trends being embraced by their Millennial and Gen Z owners 5 . Mars Petcare UK, for example, launched the Nutro brand of super premium pet food, which uses its ‘Feed Clean’ philosophy to bring the clean eating trend to cats and dogs. Just as when developing packaging for humans, brands are faced with the challenge of incorporating large amounts of information on pack and labels to demonstrate provenance. “Label innovation now ensures a whole multitude of data can be included on pack without impacting the visual appearance,” says Susan. “We are seeing more requests for multi-layered, peelable and foldout labels to accommodate brand and consumer needs, while QR codes are often printed on-label to create a new level of engagement post-purchase to detail origins of ingredients and brand story.” While premiumization of pet meals is one area of growth, in contrast there is an equally important market need to challenge pet obesity. Humanizing pets means it’s become all too easy for owners to give in to begging for food and see food as a way to keep their pets happy. According to a Better Cities for Pets survey, conducted with pet owners in Brazil, China, Russia, UK and USA, more than half (54%) of cat and dog owners always or often give their pet food if they beg for it, and nearly a quarter (22%) of cat and dog owners sometimes overfeed their pet to keep them happy 6 . “This is where flexible packaging has really come to the forefront in the pet food market” Susan comments. “Single serve packs enable superb portion control to support better weight management, as well as presenting consumers with a more convenient, hygienic option. The barrier properties of flexible packaging ensure food stays fresh and tasty and, of course, the single serve pack means little, if no waste, at all.” This last point is particularly crucial for pet food brands to take note of. 36 Technology & Marketing

Marketing With pet ownership increasing among younger generations, sustainability and environmental responsibility must remain central to packaging innovation. A study by First Insight, Gen Z shoppers demand sustainable retail, found that the vast majority of Generation Z shoppers prefer to buy sustainable brands. The report also found that Generation Z, along with Millennials, are most likely to make purchase decisions based on values and principles 7 . “In the past, flexible packaging may well have struggled to meet this criterion,” says Susan. “However, innovation and development in relation to monopolymer laminates is certainly ensuring that flexible packaging will continue to have its place in the pet food packaging market. “What is clear, is that just as we see with food products for humans, pet food brand owners have many competing trends and demands to address in order to ensure their product stands out ‘onshelf’ and delivers commercial success. Yet, another big challenge in the pet food market is the swing to ever younger pet owners. Successfully targeting Millennials has never been an easy feat for marketeers. E-commerce is the norm, they don’t really want to be sold to and attracting their attention in a crowded retail space can be difficult. Pet food brands need to ensure their packaging is creative and unique to meet their ever-evolving expectations.” Technology & Marketing References 1 EDIAF Facts & Figures 2020 European Overview: https://www.fediaf.org/images/ FEDIAF_Facts_and_Figures_2020.pdf 2 Pet Food Manufacturers’ Association: https://www.pfma.org.uk/news/pfmaconfirms-dramatic-rise-in-pet-acquisitionamong-millennials- 3 Mordor Intelligence, Europe Pet Food Market – Growth, trends, Covid-19 impact, and forecasts (2021-2026): https://www. mordorintelligence.com/industry-reports/ pet-food-market-in-europe-industry 4 Mordor Intelligence, Europe Pet Food Market – Growth, trends, Covid-19 impact, and forecasts (2021-2026): https://www. mordorintelligence.com/industry-reports/ pet-food-market-in-europe-industry 5 Mintel, Four-legged Flexitarians, February 7, 2020: https://www.mintel. com/press-centre/food-and-drink/fourlegged-flexitarians-over-a-third-of-ukdog-food-buyers-believe-its-good-forpets-to-regularly-have-plant-based-meals 6 Better Cities for Pets, Mars Petcare Program, 2018: https://www. bettercitiesforpets.com/resource/surveyweighs-pet-obesity-crisis/ 7 First Insight, The state of consumer spending: Gen Z shoppers demand sustainable retail: https://www.firstinsight. com/white-papers-posts/gen-z-shoppersdemand-sustainability For more information www.opmgroup.co.uk Issue 4 2021 37

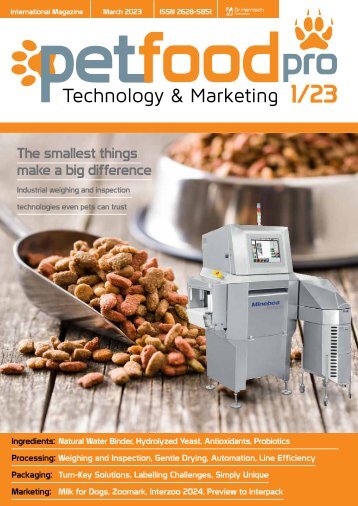

- Seite 1 und 2: International Magazine November 202

- Seite 3 und 4: editorial Teaching a New Dog Old Tr

- Seite 5 und 6: Departments 3 Editorial 42 Upcoming

- Seite 7 und 8: Ingredients textures. BENEO’s por

- Seite 9 und 10: WE MAKE PET FOOD TASTE GREAT. TM PA

- Seite 11 und 12: Ingredients predisposing to increas

- Seite 14 und 15: Ingredients CBD Oil for Animal Heal

- Seite 16 und 17: Ingredients Premium Pet Food Requir

- Seite 18 und 19: Ingredients Lockdown’s Peanut But

- Seite 20 und 21: Marketing Learning from Turtles At

- Seite 22 und 23: Marketing What do the pond turtles

- Seite 24 und 25: Marketing ADM Unveils Nutrition Lab

- Seite 26 und 27: processing Goodbye, Salmonella: Bac

- Seite 28 und 29: processing Versatile Filling & Pack

- Seite 30 und 31: processing Dairy ingredients Small

- Seite 32 und 33: processing manage incoming raw mate

- Seite 34 und 35: Packaging Recyclable Dog Food Packa

- Seite 38 und 39: Packaging Shipment of Healthier Dog

- Seite 40 und 41: Packaging Healthy and Sustainable -

- Seite 42 und 43: Last Page Upcoming Events March 10

Unangemessen

Laden...

Magazin per E-Mail verschicken

Laden...

Einbetten

Laden...