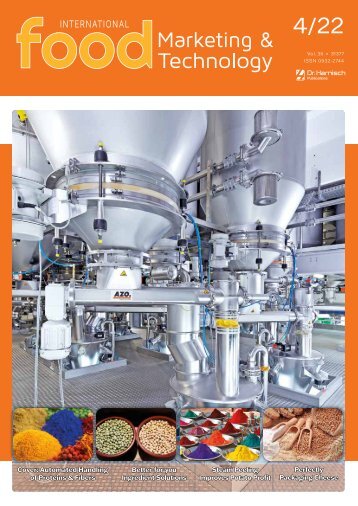

food Marketing - Technology 4/2022

Processing Spotlight on

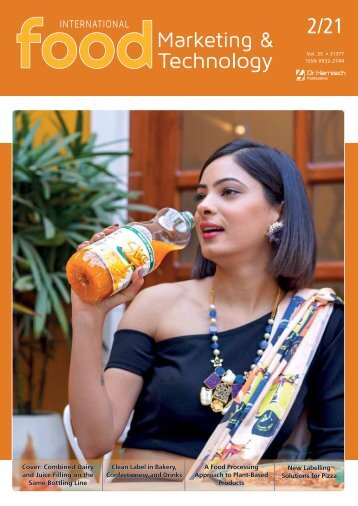

Processing Spotlight on Sorting: How Potato Processors can Improve Profitability and Sustainability by Using the Latest Steam Peeling Solutions Peeling potatoes on potato processing lines can be a bit like peeling notes from a wad of dollar bills and then throwing them away. Because mechanized peel removal also removes potato flesh, a high quantity of saleable raw material gets discarded. This is lost value and margin for a business, and over time it adds up to sums of money that food processors cannot afford to lose. Reducing food waste is one of the most important objectives of this generation. Processors, retailers and consumers increasingly focus on the origin of food and expect food producers to adopt sustainable business practices. Thankfully much of the product loss incurred during potato peeling is preventable, and this not only increases the utilization of the precious potato, but also enables food processors to produce high-quality flavorsome dishes. Another important sustainability concern is energy use in production and associated greenhouse gas emissions. By increasing the yield from every piece of raw material entering the production process, businesses can operate for a shorter time to achieve the same required output, hence saving energy costs and water usage. The good news is that automated solutions are available to address these issues. Solutions that are both environmentally friendly and commercially savvy enhance processors’ green credentials while also preventing waste from cutting away at the bottom line. As the world changes, so must processors Though it has always made good business sense to eliminate waste, this necessity is now more important than ever because of the legislative and consumer led changes facing the food industry. For one thing, demand for frozen potato products for foodservice is increasing, meaning that there’s greater pressure to increase volumes and throughputs, and more business for processors to win or lose. For example, the growth in production capacity of frozen French fries in new regions is growing each year rapidly, with each new processing line in China, Africa, and Brazil capable of delivering 150,000 tons each year. Recently we have seen supply chain issues in North America resulting in shortages in Asia. Reducing food miles is another important challenge for the potato processing industry and challenges in logistics are discouraging businesses from shipping frozen products over long distances, meaning that new potato processing facilities are being built closer to local retailers. For another, the consumer expectations of quality, flavor, and taste around the world are increasing. Consumers are getting fussier about the quality of the foods they buy, meaning that retailers are also becoming less tolerant of product imperfections. Achieving high-quality potato products from locally grown raw materials becomes essential. Innovation in potato seed has resulted in producing a wider range of new potato varieties that are more resistant to drought and wet, which is necessary due to climate change. This has helped improve the raw material consistency and quality delivered to food processors, enabling them to improve their business and product quality. But this is only part of the solution. Technology and steam peeling solutions need to be adaptable to extract the maximum benefit of the available raw material. As the world continues to change and adapt to challenges, we see that food processors need to install new lines incorporating the latest technical solutions. And aging lines will need to 20 food Marketing & Technology • August 2022

Processing be replaced to ensure the business stays competitive and survives. Increasing demand for quantity and quality Potato processors might be tempted to dismiss market forces as something that only retailers need to worry about, but this would be a mistake: just as retailers must meet changes in consumer demand, so processors must meet the subsequent changes in retailer requirements. And those requirements are not only for greater quantities, but also for greater product quality and a responsible approach to sustainability. Potatoes are a staple food, of course, ranked fourth in global production after wheat, rice, and maize. But what’s changing goes beyond the simplicity of a humble vegetable that is satisfying to eat and provides an excellent source of fiber, minerals, and vitamins: the consumption of processed potato products is really gaining popularity. This rising demand is propelled mostly by increasing economic prosperity in developing nations, where disposable incomes and busy lifestyles are popularizing westernstyle diets - including French fries as an accompaniment to food service, and convenience foods at home such as frozen potato wedges, slices, and dices. And there’s more to come. Market researchers expect the global frozen potato market to expand from a value of about bn in 2021 to about bn by 2028, equivalent to a compound annual growth rate of about 4%. That’s the kind of growth most other industries can only dream of. At the same time as buying more potato products, consumers’ expectations are increasing, and they refuse to accept bad quality food. One reason for this is that improvements in raw material, food sorting and food processing have set in motion a circle of growth in standards: as product quality improves, so the ‘new normal’ sets higher expectations. And add to that the power of social media: the tendency of customers to share experience of good and bad quality in equal measure online fuels additional pressure on businesses to protect their brand. Yet another market pressure is the rising awareness among consumers of the need to be less wasteful of resources. The Global Sustainability Study 2021 (conducted by global strategy and pricing consultancy Simon-Kucher & Partners) found that sustainability is rated as an important purchase criterion by 60% of consumers globally. An even greater proportion, 85%, have consciously made their purchasing choices’ greener’ in recent years. Key No. 103007 HYGIENE TECHNOLOGY MADE IN GERMANY Kohlhoff food Marketing Hygienetechnik & Technology GmbH • August & 2022 Co. KG Isaac-Newton-Straße 2 · 59423 Unna · Germany Phone: +49(0)2303-98183-0 · info@kohlhoff-hygiene.de www.kohlhoff-hygiene.de 21 Please visit our website for more information about our hygiene technology devices for food processing companies

- Seite 1 und 2: 4/22 Vol. 36 • 31377 ISSN 0932-27

- Seite 3 und 4: Editorial Fat People can Save the W

- Seite 5 und 6: Cutting Technology 2/9/22 10:37 AM

- Seite 7 und 8: Cover Story Whether these raw mater

- Seite 9 und 10: Cover Story A WORLD OF PACKAGING SO

- Seite 11 und 12: Ingredients for cooking and baking

- Seite 13 und 14: Ingredients Agents of Spring. She e

- Seite 15 und 16: Ingredients Online & In-Person 28 N

- Seite 17 und 18: Ingredients avocado companies manip

- Seite 19: Ingredients In China, as young gene

- Seite 23 und 24: Processing PLANT BASED PRODUCT INNO

- Seite 25 und 26: Processing Semi-active Hygienic Whe

- Seite 27 und 28: Processing reduces water consumptio

- Seite 29 und 30: Processing Onboard Processing Plant

- Seite 31 und 32: Processing enter threshold values i

- Seite 33 und 34: Digital while at the same time acce

- Seite 35 und 36: Cover Story Transforming global foo

- Seite 37 und 38: Processing Grow with the Flow Ideas

- Seite 39 und 40: Events offers for determining the i

- Seite 41 und 42: Events for customers in the food, d

- Seite 43 und 44: Events Sappi Showcases its Packagin

- Seite 45 und 46: Packaging Looking to the Future wit

- Seite 47 und 48: . 2/9/22 10:37 AM 31377 Packaging a

- Seite 49 und 50: Events Key No. 102494 food Marketin

- Seite 51 und 52: Events Speed and Sustainability - P

- Seite 53 und 54: Events 8-10 NOV 2022 DUBAI WORLD TR

- Seite 55 und 56: Events The possibilities are endles

- Seite 57 und 58: Packaging on the type of packaging,

- Seite 59 und 60: Packaging processes used in advance

- Seite 61 und 62: Events May. Inspiring, forward-look

- Seite 63 und 64: The Global Leader in Food Cutting T

Unangemessen

Laden...

Magazin per E-Mail verschicken

Laden...

Einbetten

Laden...